Table of Contents

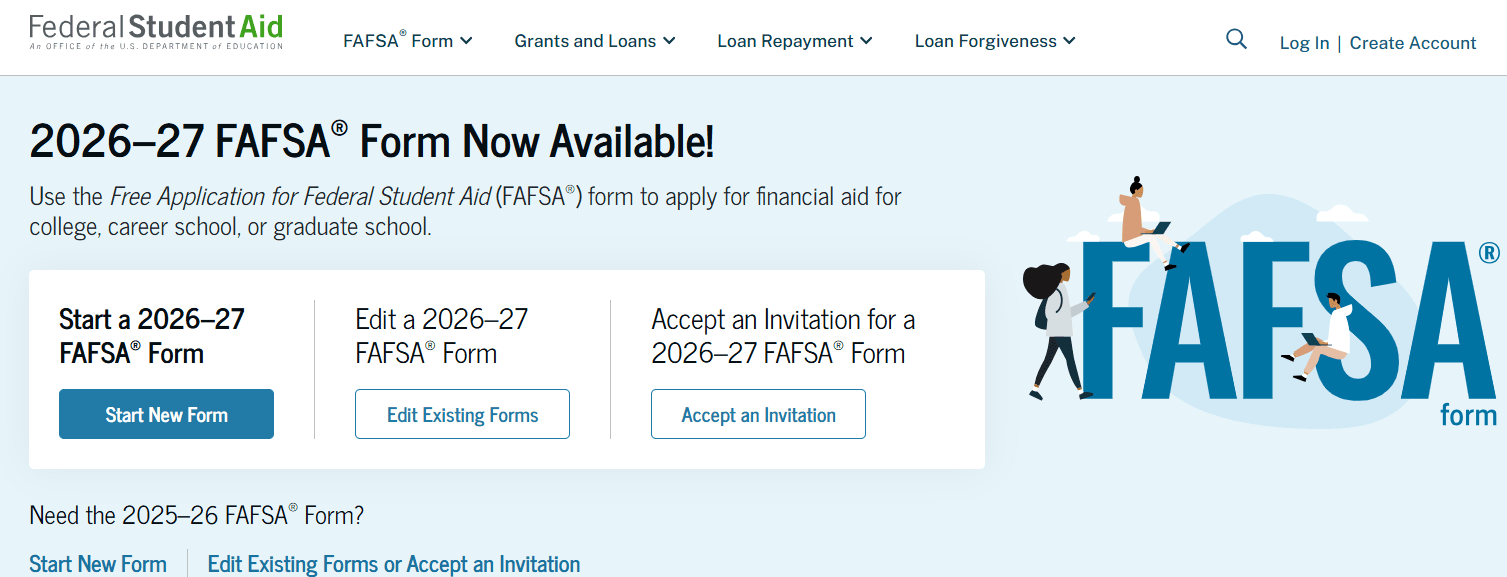

Free Application for Federal Student Aid (FAFSA)

Paying for college or career school in the United States can be overwhelming, but the Free Application for Federal Student Aid (FAFSA) is the key to unlocking financial support. FAFSA is the official form students complete to determine eligibility for grants, scholarships, federal work-study programs, and student loans. It is the gateway to the largest source of financial aid for higher education, and submitting it on time can make the difference between affording college and missing out on crucial opportunities.

What is FAFSA?

The Free Application for Federal Student Aid (FAFSA) is a form administered by the U.S. Department of Education. It collects financial and personal information from students and their families to assess their ability to pay for college. This information is then used to determine eligibility for:

- Federal grants such as the Pell Grant

- Federal student loans with low-interest rates

- Work-study programs that provide part-time employment while studying

- State and institutional aid, since most states and colleges also use FAFSA data to allocate financial assistance

The FAFSA is free to complete, and it’s the most important step students can take toward funding their education.

Why FAFSA is Important

Submitting FAFSA isn’t just about federal aid. Many states, universities, and private organizations rely on FAFSA data when awarding scholarships or tuition assistance. Without it, students risk leaving thousands of dollars in free aid unclaimed.

Additionally, FAFSA is a requirement for many campus-based aid programs, meaning even students who don’t qualify for need-based grants may still gain access to loans or merit-based aid.

FAFSA Deadlines

Deadlines are crucial when it comes to FAFSA. Missing them may result in reduced aid or disqualification from certain programs.

- For the 2024–25 school year: The federal FAFSA deadline is June 30, 2025.

- For the 2025–26 school year: The federal FAFSA deadline is June 30, 2026.

In addition to federal deadlines, many states and colleges set their own deadlines, often earlier than the federal one. Students should check their state deadlines and submit the FAFSA as soon as possible after it opens each year to maximize aid eligibility.

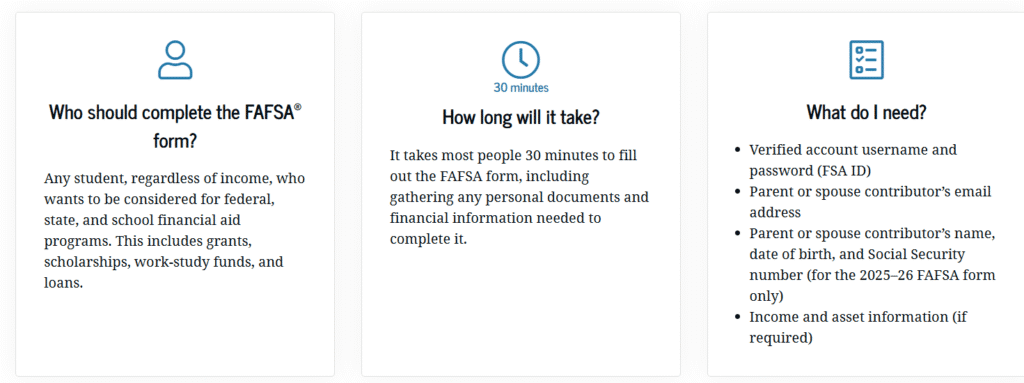

How to Create a FAFSA Account

Before starting the application, students need to create an FSA ID (Federal Student Aid ID). This ID acts as a username and password that allows students and parents to:

- Log in to the FAFSA system

- Electronically sign and submit the FAFSA form

- Access and manage financial aid records

Once created, the FSA ID can be used immediately to complete the FAFSA form. However, it may take up to three days for the Social Security Administration (SSA) to confirm the information for other uses, such as accessing account details.

Steps to Fill Out the FAFSA

Filling out the FAFSA may feel intimidating, but with the right preparation, it becomes much easier. Here’s how to get started:

1. Gather Necessary Information

Before beginning the form, students should have the following on hand:

- Social Security number (or Alien Registration number for eligible noncitizens)

- Federal tax returns, W-2s, and income records

- Bank statements and records of investments (if applicable)

- Information about untaxed income

- Parent financial information (for dependent students)

2. Log in and Begin the Application

Students can complete the FAFSA online at fafsa.gov or use the mobile app.

3. Answer the Required Questions

The form will ask about personal details, dependency status, household income, and other financial information. This helps calculate the Expected Family Contribution (EFC), which determines aid eligibility.

4. Select Schools

Students must list the colleges or career schools they want their FAFSA information sent to. Even if acceptance is pending, adding schools ensures aid is considered.

5. Sign and Submit

Both the student and a parent (if applicable) must sign the FAFSA with their FSA IDs. Always keep a confirmation copy after submission.

Checking FAFSA Application Status

After submission, students can check the status of their FAFSA by:

- Logging into their account at fafsa.gov

- Contacting the Federal Student Aid Information Center

- If submitting a paper FAFSA, checking 7–10 days after mailing

Students will receive a Student Aid Report (SAR), which summarizes the information provided. It’s important to review this document carefully and make corrections before deadlines, if any information is incorrect.

Eligibility Requirements for FAFSA

Not everyone automatically qualifies for federal aid. To be considered, students must meet these basic eligibility requirements:

- Demonstrated financial need (for need-based aid)

- U.S. citizenship or eligible noncitizen status

- Valid Social Security number

- Enrollment or acceptance into an eligible degree or certificate program

- Satisfactory academic progress while in school

Special circumstances, such as incarceration or defaulting on a student loan, may affect eligibility.

Avoiding Financial Aid Scams

FAFSA is completely free to fill out, but unfortunately, many scams target students and families by offering “paid FAFSA services.” Students should:

- Only apply through the official site, fafsa.gov

- Avoid third-party companies charging fees for application assistance

- Seek free guidance from school counselors, college financial aid offices, or nonprofit organizations

- Search for legitimate scholarships on trusted platforms rather than relying on paid services

Remember: If someone asks for money to complete FAFSA, it’s a scam.

Common FAFSA Mistakes to Avoid

To ensure maximum aid, students should avoid these common mistakes:

- Missing the deadline – Submit FAFSA early to meet both federal and state deadlines.

- Entering incorrect information – Double-check Social Security numbers, income figures, and school codes.

- Skipping dependency questions – Many students mistakenly claim independence when they are still considered dependents.

- Failing to sign the form – Both student and parent signatures (via FSA ID) are required.

- Not updating FAFSA – If financial or family situations change, update the form promptly.

FAFSA and State Aid

While FAFSA is a federal program, many states rely on FAFSA data to distribute their own aid. State grants, scholarships, and tuition assistance programs often have earlier deadlines than the federal cutoff. Submitting FAFSA early increases the chances of qualifying for both federal and state-level support.

Tips for Maximizing Financial Aid Through FAFS

- Submit early: Aid is often distributed on a first-come, first-served basis.

- List multiple schools: Even if unsure, adding more schools ensures wider eligibility.

- Reapply each year: FAFSA must be completed annually to continue receiving aid.

- Correct errors quickly: Review the Student Aid Report (SAR) and fix mistakes promptly.

- Understand family income reporting: Students from households with lower income may qualify for more grants, while higher-income families might still access loans and merit aid.

The Free Application for Federal Student Aid (FAFSA) is the foundation of financial assistance for millions of students across the U.S. Whether you are applying for grants, scholarships, work-study, or loans, FAFSA opens the door to educational opportunities that might otherwise be out of reach.

Visit Engineeringhulk.com for more informative articles.